Some Of Small Business Accounting Service In Vancouver

Wiki Article

How Cfo Company Vancouver can Save You Time, Stress, and Money.

Table of ContentsExamine This Report about Pivot Advantage Accounting And Advisory Inc. In VancouverNot known Incorrect Statements About Cfo Company Vancouver What Does Vancouver Tax Accounting Company Mean?The Best Strategy To Use For Virtual Cfo In VancouverThe Best Strategy To Use For Tax Consultant VancouverSee This Report about Small Business Accountant Vancouver

Right here are some advantages to employing an accounting professional over an accountant: An accounting professional can give you a detailed view of your business's economic state, together with strategies and also referrals for making financial choices. Bookkeepers are only responsible for videotaping monetary purchases. Accountants are needed to finish more education, accreditations and work experience than accountants.

It can be tough to gauge the suitable time to work with an accountancy expert or bookkeeper or to determine if you require one in all. While numerous local business employ an accountant as a specialist, you have several choices for taking care of monetary jobs. For instance, some small company proprietors do their own accounting on software application their accounting professional advises or makes use of, providing it to the accountant on a weekly, monthly or quarterly basis for action.

It might take some history research to discover an appropriate bookkeeper since, unlike accounting professionals, they are not needed to hold an expert qualification. A strong endorsement from a trusted coworker or years of experience are necessary aspects when hiring a bookkeeper. Are you still unsure if you require to hire someone to assist with your books? Below are 3 circumstances that suggest it's time to hire an economic specialist: If your tax obligations have come to be also complicated to take care of on your very own, with several earnings streams, international financial investments, a number of reductions or other considerations, it's time to work with an accountant.

Rumored Buzz on Small Business Accounting Service In Vancouver

For small companies, proficient cash administration is a crucial aspect of survival and growth, so it's important to collaborate with an economic specialist from the beginning. If you favor to go it alone, take into consideration starting with accounting software program as well as keeping go to this site your books thoroughly up to day. By doing this, need to you need to hire a professional down the line, they will have visibility right into the total monetary history of your business.

Some source interviews were conducted for a previous variation of this short article.

Indicators on Pivot Advantage Accounting And Advisory Inc. In Vancouver You Need To Know

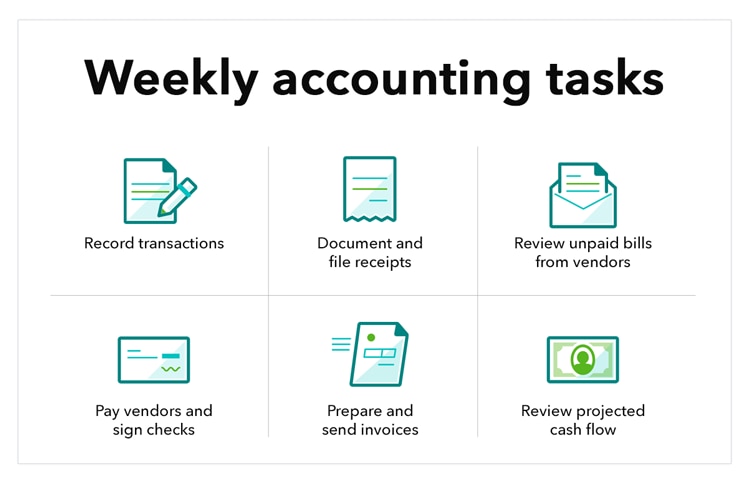

When it concerns the ins and also outs of taxes, accountancy and also finance, nevertheless, it never harms to have a seasoned professional to resort to for guidance. An expanding number of accounting professionals are additionally looking after points such as capital forecasts, invoicing as well as HR. Eventually, a number of them are taking on CFO-like functions.Local business owners can anticipate their accounting professionals to assist with: Selecting the business framework that's right for you is essential. It affects exactly how much you pay in taxes, the documents you require to file and also your personal obligation. If you're seeking to convert to a various service framework, it can result in tax consequences and also various other issues.

Also firms that are the very same size and also industry pay extremely various amounts for bookkeeping. These costs do not transform right into cash money, they are necessary for running your service.

All about Tax Accountant In Vancouver, Bc

The typical expense of bookkeeping services for tiny company differs for each distinct scenario. The typical monthly bookkeeping fees for a little business will certainly rise as you add a lot more services and the tasks obtain harder.You can videotape transactions and process pay-roll using on-line software program. Software remedies come in all shapes and also dimensions.

A Biased View of Vancouver Accounting Firm

If you're a brand-new company proprietor, do not forget to factor accountancy costs right into your spending plan. Administrative expenses and accounting professional fees aren't the only accounting costs.Your ability to lead staff members, offer consumers, and choose can experience. Your time is additionally useful as well as need to be taken into consideration when article source checking out audit expenses. The moment invested on accounting jobs does not create revenue. The less time you spend on bookkeeping as well as taxes, the more time you need to grow your service.

This is not intended as lawful guidance; to find out more, please click on this link..

The Main Principles Of Outsourced Cfo Services

Report this wiki page